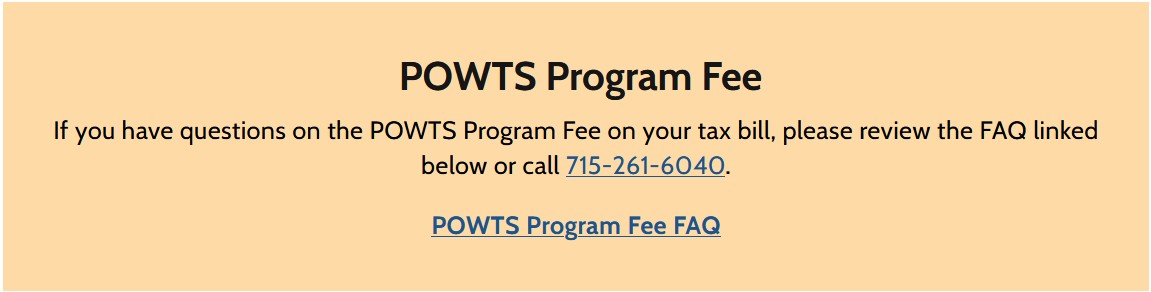

**NEW on your 2025 Taxes - POWTS PROGRAM FEES of $6.00

for each property with septeic systems in Marathon County.**

Click the image for more information.

Click the image for more information.

When are Property Taxes Due?

Tax bills are mailed by the Town of Wien Treasurer usually during the first 2-3 weeks in December. It is important to read any insert included in your bill for payment directions, times and locations or special instructions. Past and current property tax records, including statements, can be retrieved from the County's Online Land Records system. Click this image to watch a quick video on how to find your property records.

Due Dates:

Full Payment / 1st Installment --- paid to Town of Wien Treasurer January 31st

2nd Installment --- paid to Marathon County Treasurer July 31st

--Link to Dog License Information--

Where to Pay

First Installments and Full Payments

The Town of Wien Treasurer accepts first installments and full tax payments for properties located in the Town of Wien. Payments can be mailed or paid in person per the details below.

Make Checks Payable to: TOWN OF WIEN

Made By Mail:

Town of Wien

Margie Wenzel - Treasurer

120713 Blackberry Rd

Edgar WI 54426

Made by In-Person Meeting (at Town Hall ONLY):

*Note - In person payments will not be accepted at Treasurer’s personal residence. Please plan accordingly.

- Sunday, Dec. 28th 5:00 PM – 7:00 PM

- Wednesday, Dec. 31st 6:00 PM – 8:00 PM

- Saturday, Jan. 10th 9:00 AM – 11:00 AM

- Sunday, Jan. 25th 5:00 PM – 7:00 PM

- Saturday, Jan. 31st 9:00 AM – 11:00 AM

--Link to Dog License Information--

Second Installments and Late/Delinqent Payments

Second installments and late payments are paid to the Marathon County Treasurer. See more information at the link below or on your tax bill. NOTE: Do not send these payments to the township!

Late payments and delinquent taxes are managed by Marathon County Treasurer. See more information at the link below. NOTE: Do not send these payments to the township!

https://www.marathoncounty.gov/services/property-land-information/property-taxes

- County Treasurer

Marathon County Courthouse

500 Forest Street

Wausau, WI 54403 - P: 715-261-1150

F: 715-261-1166

[email protected]

--Link to Dog License Information--

Lottery Credit

Only owner-occupied homes will be eligible to receive the Lottery Credit. If you received the lottery credit previously as a owner/occupant, you will be automatically pre-certified unless you have changed the legal description. If the Lottery Credit does not appear on your tax bill and you qualify, you can fill out a late claim form. Your local treasurer can apply the credit to your first installment or full payment before January 31st. After January 31st, you can still apply until October 1st through the Department of Revenue. Remember, this is for owner occupied residences only.

The Lottery rate and base value changes for each tax season. The lottery credit is the equalized school tax rate X a base value determined by the Department of Revenue.